Foresight - Winter 2023

- A.F.T. Trivest

- Dec 1, 2023

- 8 min read

Updated: Aug 19, 2025

The Fall 2022 Foresight discussed our expectations for volatility in financial markets (both up and down) to be a major theme going forward, as markets adjusted to the higher interest rate environment. A year later, we expect that theme to continue. Both the TSX Composite and US S&P 500 have had multiple swings of 5% or more through 2023, masking the fact that both markets are up year-to-date (TSX-4% and S&P 500-18%) - a reasonable-enough performance, given TSX earnings are expected to be down 8% and S&P 500 earnings up 1.7% year-over-year.

On the fixed income side, the chart shows the current yield-to-maturity for various Fixed Income ETFs and GICs we hold in your portfolios. As we have written previously, today’s higher bond yields will have a significant positive impact upon portfolio returns going forward, compared to the past (see back page article).

Name | Symbol | Yield to Maturity |

BMO Long Provincial Bond Index ETF | ZPL | 4.95% |

iShares 20+ Year US Treasury Bond ETF | TLT | 4.70% |

iShares 1-5 Year Laddered Government Bond Index ETF | CLF | 4.25% |

iShares 1-3 Year US Treasury Bond ETF | SHY | 4.96% |

iShares Floating Rate Index ETF | XFR | 5.24% |

iShares US Treasury Floating Rate Bond ETF | TFLO | 4.82% |

Evolve High Interest Savings Account ETF | HISA | 5.3% |

Canadian GICs (1 to 5 year) |

| 5.5% to 5.0% |

Although we have recently started adding 1 year and 2 year GICs to portfolios, overall they remain a small proportion of your fixed income portfolio because the small yield premium does not offset the illiquidity factor of GICs over their 1-5 year maturities.

Positive news for October saw inflation slow in both Canada (3.1%) and the US (3.2%), increasing expectations that the Bank of Canada and the US Federal Reserve are at, or close to, the end of their interest rate increases. In fact, we might see a lowering of interest rates in the second half of 2024. Even a 1% decrease in interest rates would have a significant positive impact on our bond portfolio returns through 2024. Lower interest rates would also help relieve the pressure that higher rates have on interest-sensitive equities like banks, utilities and growth stocks. Between the potential for a return to corporate earnings growth and the positive impact of slightly lower interest rates, 2024 could shape up to be a reasonable year for portfolio returns.

First Home Savings Account (FHSA)

The 2022 Federal Budget threw an old hat into the ring of home ownership. From 1974-85, there was such a vehicle called a Registered Home Owners Savings Plan. It was replaced in 1992 by building the Home Buyers’ Plan (“HBP”) into the existing RRSP system, which continues to the present day. According to StatsCan, this program has assisted 650,000 new homebuyers withdraw $6.2B for home purchases.

The rules for the new FHSA is a hybrid of programs extant. As with all such government incentive programs, the list of compliance rules is large, and the CRA website currently warns “more information will be available at a later date”. That is code-word that the Ministry of Finance is trying to figure out all the problems that inevitably will arise.

Eligibility - you must be:

·At least age 18 in the year of opening the account

No older than age 71 in the year in which the account is closed

·A Canadian resident

Like HBPs, you must not have resided previously in an owned home in the calendar year of account opening and the previous four calendar years. Like RRSPs, becoming non-resident in Canada allows you to leave alive the FHSA extant, but you won’t accrue annual room, and a withdrawal is taxable like a non-resident RRSP. FHSAs have a maximum 15 year duration .

Life-time and annual contribution room:

$8,000 per year in which an FHSA account is in existence

$40,000 maximum life-time contributions

Carry forward of unused room only measures upon opening an FHSA account. In other words, you don’t commence to accrue annual room until you open an account (different from a TFSA which automatically accrues new room every January 1st for every adult Canadian)

Unlike RRSPs, contributions must be made within the calendar year (ie not by 60 days after)

Like RESPs, you can only catch up one past year of unused room per year

Tax matters:

Unlike TFSAs, contributions are tax deductible, and in the same fashion as an RRSP, meaning that deductions can be deferred as “unused deductions” for future marginal tax rate advantage

If the account is collapsed to make a “first time” home purchase, the withdrawal is not taxable

This is a good result...as the contribution is tax deductible but the qualifying withdrawal is tax-free. This feature IS the essence of this new program. Furthermore, if the FHSA ultimately is used for “first time” home purchase, then withdrawal of all of the accumulated rate-of-return income is tax-free too, like a TFSA.

In one’s 71st year, the FHSA must be closed via three scenarios: buy a home in that final year (as the program intends), collapse and pay tax on the withdrawal (like de-registering an RRSP) or transfer the funds to a RRIF or RRSP.

Estate Matters:

Beneficiaries of a deceased’s FHSA will be identified either through account designations or through a Will. The tax treatment of the FHSA at death depends upon the beneficiary. If the beneficiary is a legal spouse who qualifies for a FHSA (as above), then the FHSA account transfers as is. If the beneficiary does not qualify for a FHSA, then that account ceases and the beneficiary can either transfer those funds directly to an RRSP/RRIF, or pay tax now on the proceeds. There are many more estate rules not covered herein. Also, estate matters in Canada are in provincial jurisdiction, so the provinces will need to respond with their own legislations.

Strategy:

In deciding when to open an FHSA, one may be caught between constraints in the rules:

a) the five years of $8,000 contribution room only start upon opening the account

b) you therefore accumulate the annual $8,000 of room in those first five years

c) Your annual contributions can only max at two years of room per year...so eg, if you start contributing at year 6, it will take three years to contribute the $40,000

d) the account can only exist for 15 calendar years

In the background of all of this is your own life story:

a) Are you able to fund these contributions from savings? On what time-table?

b) When do you decide you want to be a homeowner?

c) From moment b), how much lead time does that give you to contribute the full $40,000 value of FHSA?

If you are eligible as described above, and even if you have no intention of being a homeowner, opening an FHSA would appear to be wise. Effectively, it creates up to $40,000 of new contribution room for you (beyond your earned income room to an RRSP), which can transfer, as noted above, to your RRSP/RRIF pension accounts before age 72, along with its rate-of-return growth over the years. You would have to execute the transfer earlier if the 15 year lifespan expires before you attain age 71.

The legislation contemplates the opposite - transferring RRSP funds to an FHSA. The amount of the transfer is bound by the FHSA annual and life time limits, as above. This strategy also may fall afoul of the system of generating life time room....see the “Contribution Room” section.

Presumably, the reason to do this is because you foresee buying your “first home”, and withdrawal of these transferred funds would be tax-free, achieving the same good tax result of a tax deductible contribution and tax-free withdrawal. Secondly, the home purchase decision may have arisen suddenly and unexpectedly. Thirdly, there may be a scarcity of cash sources for the down payment portion.

The RRSP HBP extant allows a withdrawal from your RRSP to buy that “first” home, which must be paid back, or taken into income, annually over 15 years.

The new FHSA rules preclude a “double dip” from both the FHSA and the RRSP Home Buyers Plan. Given the differences between the two options, the new FHSA is the better option (and see the “transfer” option above).

Investing strategy:

Canadian financial institutions (including NBIN) have all added this “product” into their systems. Given the rules, it is ironic that thousands of these accounts may get opened over the next year and may actually have NO balances in them… because they need to be opened just to start the annual $8,000 room. Clients may not contribute for years. Given the rules, the accounts can only accumulate $40,000 of capital; so, by definition they all will be small. Then there is the investing strategy with small accounts with unknown, or at best, short time horizons. Prudent investing strategy asks two questions, in order: What’s the money for? Then When is it for? With FHSA, the What is relatively clear, the When may not be. Or, if it is known, it is likely too short to gamble on the gyrations of the stock market. That means that fixed income may be the only wise investment of choice for FHSAs, and it needs to be liquid, not locked in for GIC maturity periods.

This article effectively is only an instalment on this new topic. More will follow as further refining legislations evolve.

Investing Update

In the Spring issue, we updated recent investment returns to March 31st. We roll forward here for the following six months to September 30th. As of last March, we had experienced nine rolling twelve-month periods with negative portfolio returns (from -0.58% to –5.24%) and three periods of modest positive returns under 4%. We noted last year that fixed income returns had run mostly negative from July 2021 through February 2023. The astonishing coincident negative returns in both fixed income and equity returns ran from June 2022 until February 2023. This is historically extremely uncommon. Notably, historical data analysis strongly infers that both equity and fixed income perform poorly when inflation is high (which we have been experiencing world-wide).

The rolling returns for these last six months since March have all turned positive (from 0.34% to 8.59%). However, fixed income returns continue to languish. The Market returns of dividends plus appreciation have contributed no less than 70% of portfolio return, and as much as 100%, over these last six period-ends. Fixed income has contributed positively to portfolio returns in only 14 of the last 33 rolling twelve month periods. Up-and-coming Boomer Gen-retirees got their early adulthood experience with investing in the early Eighties, when inflation, bond yields and mortgage rates all hit the stratosphere. Now known retrospectively as the Golden Age for Bonds, this era had a long run from 1982-2014.

As Lenin said….”There are decades when nothing happens and there are weeks when decades happen”.

Our recent Foresight editorials have alerted investors to this period of small-ish but on-going volatility. Here we need to remind investors that “volatility” is a two-way street: pessimists only see volatility as meaning “going down”. The daily or monthly Market watcher will get mired in these short term perturbations, even as they cancel each other out. Compound return data are a good antidote! At Trivest, we have been calculating and reporting returns and compound returns for 30 years. Contrarily, the present Industry standard is working towards 1,3 and 5 year compound data. The thirty-year annual compound return is powerful stuff. Its like an investor’s life-term report card. But, even the short three year statistic is insightful. Nobody would dare to call three years “long term”, but nonetheless, as Lenin said, a lot of history can happen in just three years. Your annual, simple returns over any three year period can vary a lot, bending to the news of the day. But historical data analysis shows that equity down-drafts tend not to be very long-lived. So even that short three year compound stat can smooth out a climb up the Worry Wall.

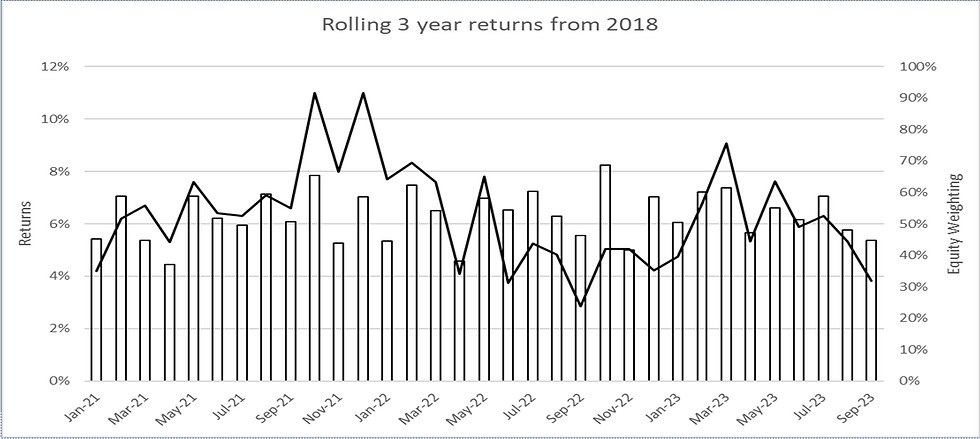

The line graph (on the left scale) shows the annual compound returns for specific files encompassing running three year periods from January 2021 to September 2023. The bar graph (on the right scale) shows the equity proportion of the portfolio. With the different equity proportions, the rolling three year returns are not directly comparable. For most of the data points, higher (equity proportion) bars led to higher lines, as equities have outperformed bonds, as discussed above. Across all the data points, 3 year compound returns have been 4-8%.

Comments